The Darvas box is one of my favorite technical patterns. This is a very simple and easy way to identify technical arrangement that follows a distinct supply and demand pattern.

What is the Darvas box?

A Darvas box is a consolidation pattern. This pattern has a distinct bottom and top where the price of the security reverses. This pattern was made famous by Nicholas Darvas and his book, “How I Made $2,000,000 In the Stock Market” written in 1960.

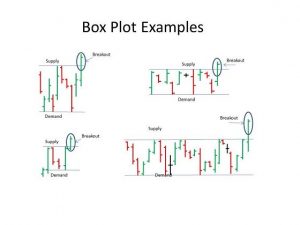

This type of pattern fits the supply and demand theory very well. There is a definite area of buying/demand and selling/supply that is used to identify this pattern. This supply and demand war will play out over a couple of weeks to several months. At that point, either supply or demand will get exhausted and a breakout should occur where the winner (supply/seller or demand/buyers) will drive the price outside of the box plot. When the breakout happens it can signal a powerful money-making move. Increased volume around the break-out is a great additional indicator to help improve your chances of success.

Works on Different Time Frames

You can use short time frames or longer time frames to create your setup for the Darvas box depending on your trading strategy. The beauty of this pattern is it works on all different time frames. So you can build your trading strategy based on your personal trading psychology.

Below are a few examples of what this pattern may look like. These are very clean charts. Sometimes, especially when there are several throw-overs, this pattern can get very hard to identify. So it does take some time to learn to identify this chart pattern.

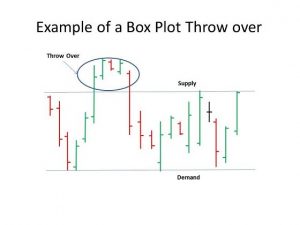

As with any type of chart pattern the Darvas box is not perfect. There will be times where you get a breakout from the plot only for it to come back into the box and stay there for several weeks or months. This is called a throw-over. The throw-over happens in just about any type of chart pattern. It is important to understand and learn how to identify a throw-over when you are trading chart patterns.

Typically, a throw-over should be quick. The move breaks out only to move right back into the Darvas box. If the throw-over stays out of the box for very long then it should be classified as another box plot and you should re-evaluate the pattern.

When identifying throw overs one thing to keep in mind. A breakout that quickly comes back into the box and does not hold at the bottom of the plot could be a signal the security is ready to change the stock’s trend. If you build your trading systems to allow for short trades, this can be a very good short trade.

Three Rules to Help You Trade the Darvas Box Successfully:

- The higher number of boxes the security makes the more likely the security is about to reverse. For example, if you find a security that has made four or more box plots patterns over the past six months to a year, then the security maybe over extended and ready to correct because it has got ahead of itself.

- The tighter the consolidation pattern the more predictable the move is after the break out.

- The longer the consolidation the better your chance of making big money.

These rules will be highly affected by the broader market. In a bull market, it won’t matter the number of boxes or the size of the consolidation. In a sideways market, you will have a whole lot more success following the rules above. Staying long this strategy does not do very well in a bear market. What I have seen happen with this pattern in a bear market is you get consolidation and a break out only for it to roll over and stop you out just in time for another stock to break out and do the same thing to you. Death by a million cuts and it is not pretty! This is when you need to be flexible and start looking for the throw overs that fail and do not hold at support.

If you decide to trade this type of pattern you need to be sure patience is one of your strengths. The reason you need patience with the box plot is the fact that you could get all or most of your gain within a couple of days to a week but you may have waited for a couple of months for it to play out.

Leave a Reply